In the US and Europe there are market research

firms that release a monthly report about how the industry is doing, hardware

and software sales, these are the NPD Group and the Gfk. As they are the only

companies to do that business in those areas their numbers are, for the most

part, not revealed to the public, that of course isn't an issue in Japan where

we have 3 trackers that release data on a weekly basis.

Due to that all the information on this blog

post is freely available on the website (as well as other corners of the

internet) for anyone to use so if you want to check the data yourself go to

Game Data Library, where all the data is listed.

That's that for the introduction, this post

will have similar information that the GSD and NPD Group makes public monthly:

bestselling games, best-selling hardware, software and hardware moved as well

as any more relevant information, note that for sales data we'll use the one

that's officially released while for revenue it'll be estimations.

For all intents and purposes, the period we're

calling January was from December 30th, 2019 to February 2nd,

2020 (5 weeks)

For the past few years we’ve grown accustomed

for January to be a strong month as many publishers are releasing big games

outside the main holiday season and before the end of the fiscal year, however,

this January is the weakest we’ve seen in some time as the new games didn’t do

as well as expected, causing overall software sales to be down, even if

hardware sales remain high.

- Hardware: Over 15 billion yen in revenue came from hardware, it’s a 40% drop over last January, as with the past few months most hardware sales and revenue came from Nintendo Switch as sales of the PlayStation 4 collapsed after its brief price drop ended, with the system seeing its weakest January since 2015 while the Nintendo Switch keeps on climbing.

- Software: Over 13 billion yen in revenue came from retail software, it’s a nearly 50% drop in comparison to last January, the lack of notable releases keep affecting software sales as once again Nintendo Switch was the top seller of software on units sold and revenue, just as with hardware this was the worst January for PS4 software since 2015.

Software

The best-selling games of January 2020 were:

- [SWI] Pokémon Sword / Shield – 391.603 (Over 2.2 billion in revenue)

- [PS4] Yakuza 7: Like a Dragon – 217.870 (Over 1.9 billion in revenue)

- [SWI] RingFit Adventure – 157.118 (Around 1.3 billion in revenue)

- [PS4] Dragon Ball Z: Kakarot – 129.072 (Over 1 billion in revenue)

- [SWI] Dr Kawashima's Brain Training for Nintendo Switch – 97.835 (Over 300 million in revenue)

- [SWI] Minecraft: Nintendo Switch Edition – 97.621 (Over 300 million in revenue)

- [SWI] Mario Kart 8 Deluxe – 97.483 (Around 550 million in revenue)

- [SWI] Super Smash Bros. Ultimate – 90.269 (Ove 600 million in revenue)

- [SWI] Luigi's Mansion 3 – 84.124 (Around 500 million in revenue)

- [SWI] Mario & Sonic at the Olympic Games Tokyo 2020 – 69.507 (Around 400 million in revenue)

Pokémon Sword / Shield has been the best

selling game in Japan for three months in a row, they are the second game to do

that since Super Mario Maker 2 did it from June to August last year, while they

are behind titles such as Pokémon X / Y and Sun / Moon launches aligned it’s

January sales were considerably higher than either of those titles, it’s the

second best performance for a Nintendo Switch game on January after last year’s

Super Smash Bros. Ultimate. We know that digital sales for the game are quite

high, as with that it has sold over 4 million units, surpassing total sales of

Pokémon Sun / Moon, as for this entry GameFreak has opted to do DLC expansions

rather than a new release we should see it selling well for the whole year.

The biggest new game to release this month was

SEGA’s Yakuza 7, they took a gamble with this new entry as it stars a brand new

character and, more notably, change the battle system, from what was a brawler

to a turn based RPG. As the Yakuza series has been in decline for the entire

PS4 generation, with Yakuza 6 and Yakuza

Kiwami 2 being the lowest selling main game and 2nd worst selling

game in the series respectively, even spin offs such as Fist of the North Star:

Lost paradise also had underwhelming sales, such a drastic change may be worth

trying.

Whether or not SEGA’s experiment will pay off

remains to be seen, but the game had a soft launch as expected, debuting below

Yakuza 6 but showing some decent legs, if turn based Yakuza will stick will be

seen on sales of future spin offs or with Yakuza 8 (assuming they stick with

the format).

The other big game for the month was Dragon

Ball Z: Kakarot, Bamco’s new DBZ game is a lengthy RPG that adapts the entirety

of DBZ story line. For the past few years, outside of 3DS games, we’ve learned

not to expect much from Dragon Ball games in Japan, so there were low

expectations for this one, with that being said, it had a fairly decent launch,

being the biggest launch for a Dragon Ball game on PS4.

As you probably noticed the rest of the top

sellers are old games, RingFit Adventure keeps performing very well and is

still supply constrained 4 months after release, this one should be a mainstay

among the top sellers for months to come, and yes, it should have no problem

selling over 1 million units. The new Brain training game (released on late

December, first time we’re talking about it) is also doing well with very soft

drops week on week, while the game is performing nowhere near what the series

did on it’s heyday on Nintendo DS, it is doing well in comparison to the last

entry on 3DS, this is the kind of game that may sell alongside RingFit

Adventure to the more casual audience on Nintendo Switch, it’ll be interesting

to see how it performs in the upcoming months, especially after Animal

Crossing: New Horizon releases.

Other old, but not so old games also keep

selling well, as Luigi’s Mansion and Mario & Sonic had softer post-holiday

drops than expected, the latter still has the actual Olympics later this year

for a final push, while it’s hard to say if Luigi’s Mansion 3 will be able to

launch sales of its predecessor.

Super Smash Bros. Ultimate is on its 2nd

January among the top sellers, while it’s the 3rd for Mario Kart 8

Deluxe.

The best-selling games of the past 12 months

- [SWI] Pokémon Sword / Shield – 3.379.737 (Over 20.5 billion in revenue)

- [SWI] Super Mario Maker 2 – 847.904 (Over 5.1 billion yen in revenue)

- [SWI] Super Smash Bros. Ultimate – 735.404 (Over 4.08 billion in revenue)

- [SWI] RingFit Adventure – 652.757 (Over 5.3 billion in revenue)

- [SWI] Minecraft: Nintendo Switch Edition – 621.959 (Over 2.1 billion in revenue)

- [SWI] Mario Kart 8 Deluxe – 603.943 (Over 3.3 billion in revenue)

- [SWI] Luigi’s Mansion 3 – 590.122 (Over 3.5 billion in revenue)

- [SWI] Dragon Quest XI S: Echoes of an Elusive Age - Definitive Edition – 482.833 (Over 4 billion in revenue)

- [PS4] Monster Hunter: World - Iceborne Master Edition – 430.813 (Over 2.8 billion in revenue)

- [SWI] Super Mario Party – 405.998 (Over 2.8 billion in revenue)

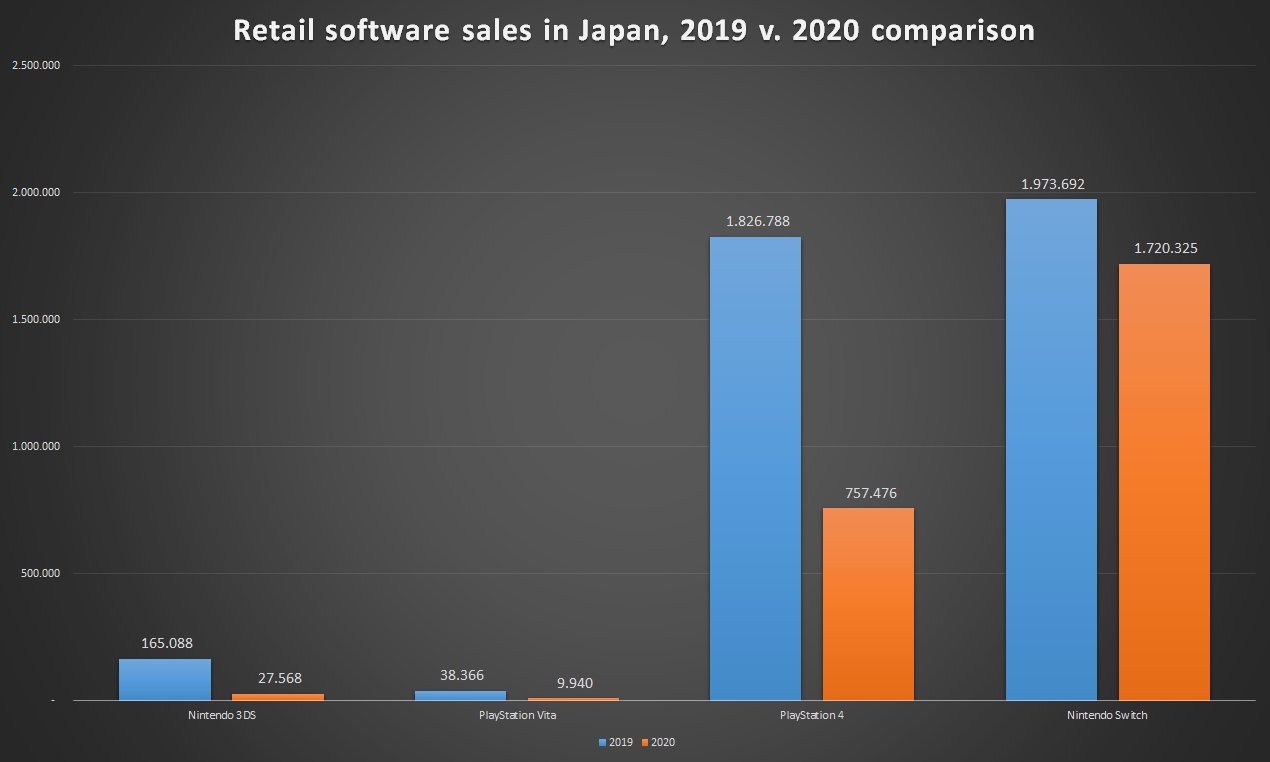

More than 2.5 million games were sold in Japan

for January, a 40% drop from last January, once again most software sales come

from Nintendo Switch games, which despite no major launches for the month, moved

over 1.7 million games seeing a 13% drop over last January, meanwhile

PlayStation 4 is off to its weakest start of the year yet, moving 750k games

seeing a 58% drop over last January. 3DS and Vita moved less than 40k games.

Nintendo starts off the year as the top

publisher, having sold over 830k games on January, unsurprisingly after

Nintendo go the Pokémon Company having moved over 400k games. SEGA, Bandai Namco

and Microsoft round up the top publishers for the start of 2020.

Hardware

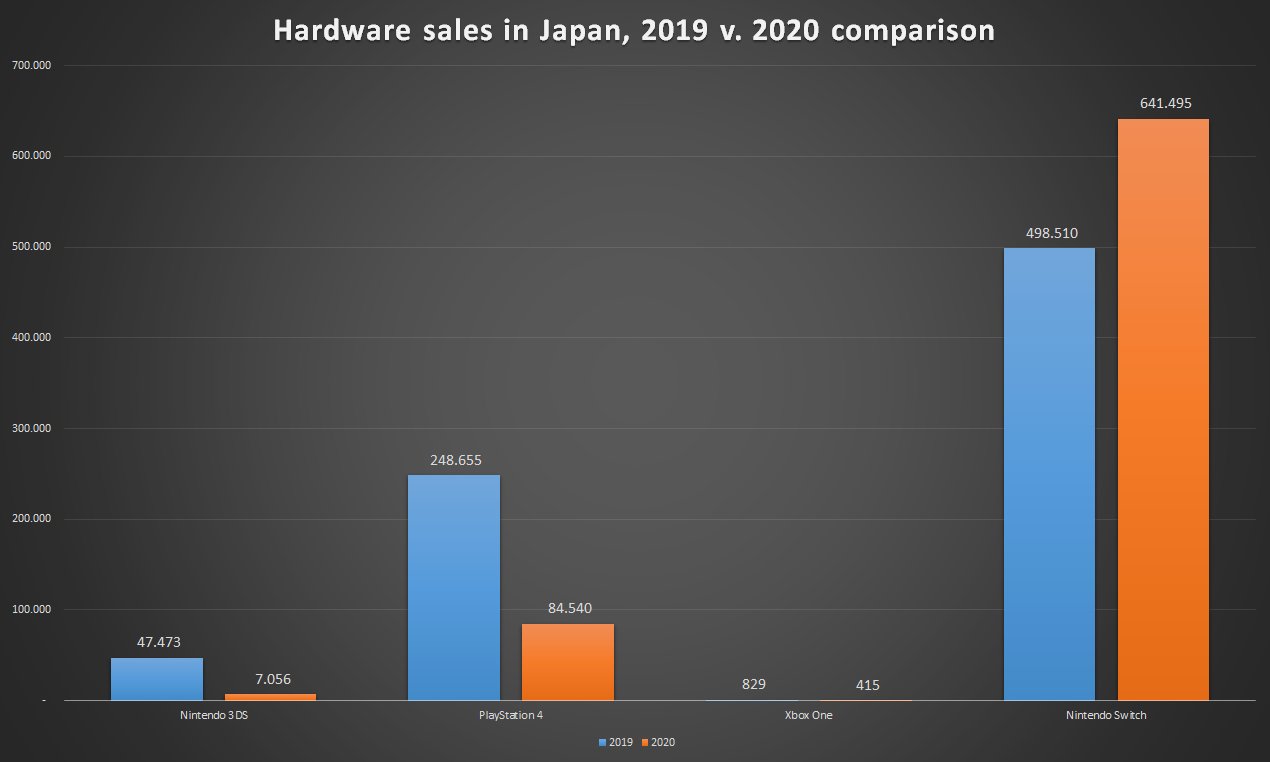

Nintendo Switch is the bestselling hardware in

Japan for the 23rd month in a row seeing it’s biggest January yet

moving over 640k units, sales of the original Nintendo Switch SKU still lead

sales as the cheap Lite keeps on track. PlayStation 4 on the other hand sees its

weakest January yet, selling less than 100k units, it’s one of the most

one-sided months we’ve seen in some time.

It’ll be interesting to see how the outbreak of

the COVID-19 coronavirus affects hardware sales in the upcoming months, as

factories across China are closed this will affect the production of videogame

hardware. Nintendo already announced how it’s affecting Nintendo Switch

production, they have also moved some of the system’s production out of China

it’s unlikely factories outside the country will be able to produce the system

in order to meet demand, so it mostly depends on how many units are on

warehouses for the time being.

PS4 is less likely to be affected by this being

a much older system, chances are that there’s more than enough stock for some

time, and it’s not like demand it’s all that high anyway. Additionally, it’ll

be interesting to see if this somehow affects the launch of the Xbox Series X

as well as the PlayStation 5, even if those are still ways away.

No hay comentarios:

Publicar un comentario